How are Landlords Being Impacted by COVID-19?

With the economic shutdown across the country still putting the brakes on many industries, there has been a flow-on effect through many different industries.

For investors, one of the problems they’ve been facing is whether or not their tenants are going to be able to pay the rent for the next six months. We’ve already seen Prime Minister Scott Morrison’s moratorium on evictions cause confusion across the country and now the states have been slowly catching up and imposing a range of different laws that will protect renters.

However, there are some people, including the real estate bodies that still feel landlords and investors have been disproportionately impacted by the rental law changes that will likely be in place for the next six months.

So how are landlords across the east coast faring with the recent emergency measures?

NSW

The NSW State Government has followed suit with most states and is implementing a six-month moratorium on evictions for tenants who fall into arrears with their rental payments. So at this point in time, landlords are unable to evict tenants.

Instead of a payment to tenants who are impacted by COVID-19, if landlords are under pressure because the rent is not being paid, the Government has looked to land tax relief.

If a tenant has lost 25% of their income, the landlord (property owner) is able to get a 25% discount on their land tax. However, the landlord must then, in turn, pass that on to the tenant.

VIC

Unlike NSW, Victoria has worked to give relief directly to tenants. A rent relief payment of up to $2,000 has been made available to tenants who are experiencing hardship because of COVID-19.

The program is a part of an $80 million rental assistance fund, set up by the Victorian Government, however, there are some strict criteria that need to be met before a tenant qualifies.

The renter must be earning less than $100,000 per year and have less than $5,000 in savings. They must also be paying more than 30% of the income in rent.

The Government has suggested that the onus will fall back on the tenant and landlord to negotiate the terms.

As with NSW, there is also the six-month moratorium on evictions.

QLD

Early in the piece, it appeared that QLD was going to be one state that severely favoured the tenant. However, the real estate bodies lobbied hard and a number of the areas have been would back, bringing the program more in line with the rest of the country.

Like both NSW and Victoria, there will be the six-month moratorium on evictions, which is backdated to 29 March. They cannot also be listed in a tenancy database for rent arrears.

If tenants have a fixed-term lease that is due to expire during the COVID-19 pandemic, they can extend their lease until 30 September 2020 if they choose.

Tenants can break a lease with capped fees if they have lost 75 per cent of their income and savings of less than $5,000.

They will also be able to claim COVID-19 rental relief if they have lost 25 per cent of their income and if their rent exceeds 30 per cent of their income. There is land tax relief available and it is available if tenants fall into financial difficulty.

A tenant can also refuse to have a physical inspection of their property for non-essential reasons but will be required to do a virtual inspection. Owner obligations for routine repairs and inspections have been relaxed, but regulatory requirements to ensure tenant safety in the rental property continue to apply.

Challenging Times for All

It’s important to note here, that rent in arrears will still need to be paid. If you are impacted by a tenant that has fallen on hard times, it’s important to work with together on the issues.

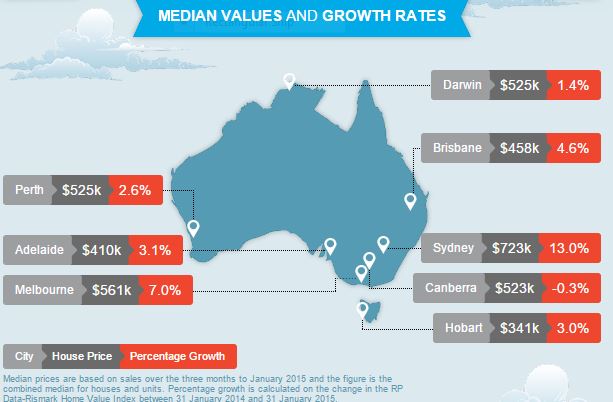

Generally speaking, the hardest-hit areas of the market appear to be those that are reliant on tourism. Outer suburbs are lower socioeconomic areas are likely to be the ones that feel the brunt of job losses and reduced income levels – which would lead to an inability to pay the rent.

High yielding short stay accommodation has been an appealing investment in recent years with the rise of platforms such as Airbnb but now many are asking whether it’s worth the risk, compared to traditional long-term rentals in blue-chip areas.

We always look to invest in premium locations aimed at the higher end of the market and in times like this when the quality of tenant is more important than ever, it’s clear how vital this is.

Dr Unterweger is a highly qualified financial and property adviser, experienced venture capitalist and successful investor

Dr Unterweger is a highly qualified financial and property adviser, experienced venture capitalist and successful investor

Blowing in the wind

Blowing in the wind